From the beginning of my career in agriculture, I’ve preached quality. Productive land with quality soils, good drainage and a good location will tend to be a sounder investment in all types of markets.

It isn’t the only factor, to be sure. There are farmers and investors who have made good income and profits in land that crosses the quality spectrum, from poor soils to the very best. But on balance, higher quality tends to be a better investment. Certainly, it produces a higher return. Better farms produce more corn, soybeans and other crops. They command higher cash rents. But how do the land values themselves hold up?

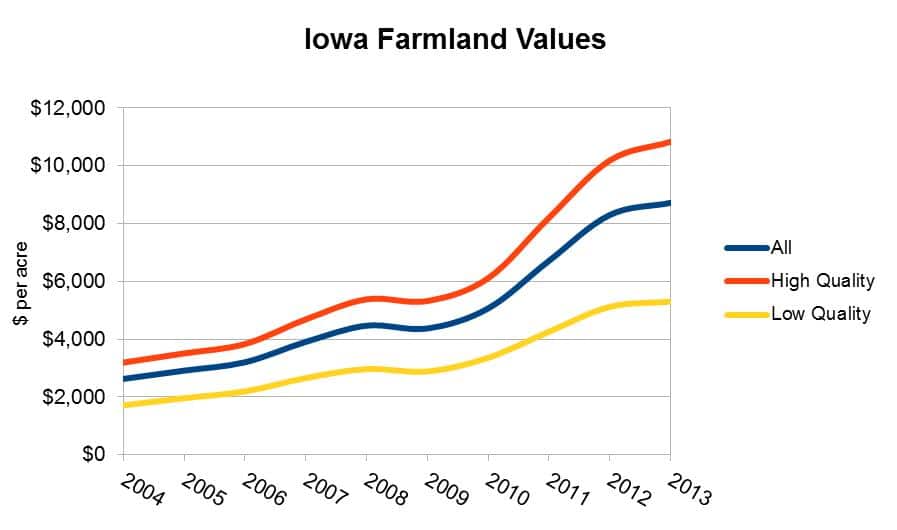

Given the remarkable increases we’ve seen in farmland during the past decade, I decided to look at how the quality of land has affected prices over the last few years. The best numbers for this come from Iowa, where Mike Duffy (who is retiring this year) has long done a valuable service to the industry with his annual Farmland Value Survey.

The survey (which will continue after Mike’s retirement) only covers Iowa, but there’s hardly a more important farm state. To get a comparison, we took the Land Survey’s values for “High Quality” and “Low Quality” land from 2003 to 2013. You can see the results on the chart below.

While higher quality land lagged for the first three years, it held (or grew) its value better every year from 2007 to 2013 except for 2010, which was basically a tie. More importantly, what we’ve seen in the first half of 2014 is that the highest quality ground in the I-states (Iowa, Illinois and Indiana) continues to generate eye-popping sales results in the $12,000, $13,000 and even $14,000 per acre range. Farms with less than A quality soils haven’t done as well. Some have been “no-sales” at auction, and others have sold at values that were $500 to $1,500 less than a year ago.

Anecdotally, this also matches my experience in previous periods of declining commodity prices. To be sure, there is success to be made in farms of varying quality, and the very best farms aren’t always available. We’ve successfully sold farmland of every conceivable type. But when all things are equal, I’d rather have a good farm than a marginal one.

On a personal note, I want to wish Mike Duffy a long and happy retirement. Thanks, Mike, for your many years of service to farmers and farmland investors in Iowa and beyond.