Current Listings

-

Riverside DairyThe facility has three robot rooms with four Lely robots each and six robot rooms with a single Lely robot for a total of 18 Lely robots. Of the 18 robots, six are included in the sale, and the other 12 Lely robots are leased through Farm Credit Leasing.270± Acres - 1,080 Head Milking Capacity

Riverside DairyThe facility has three robot rooms with four Lely robots each and six robot rooms with a single Lely robot for a total of 18 Lely robots. Of the 18 robots, six are included in the sale, and the other 12 Lely robots are leased through Farm Credit Leasing.270± Acres - 1,080 Head Milking Capacity -

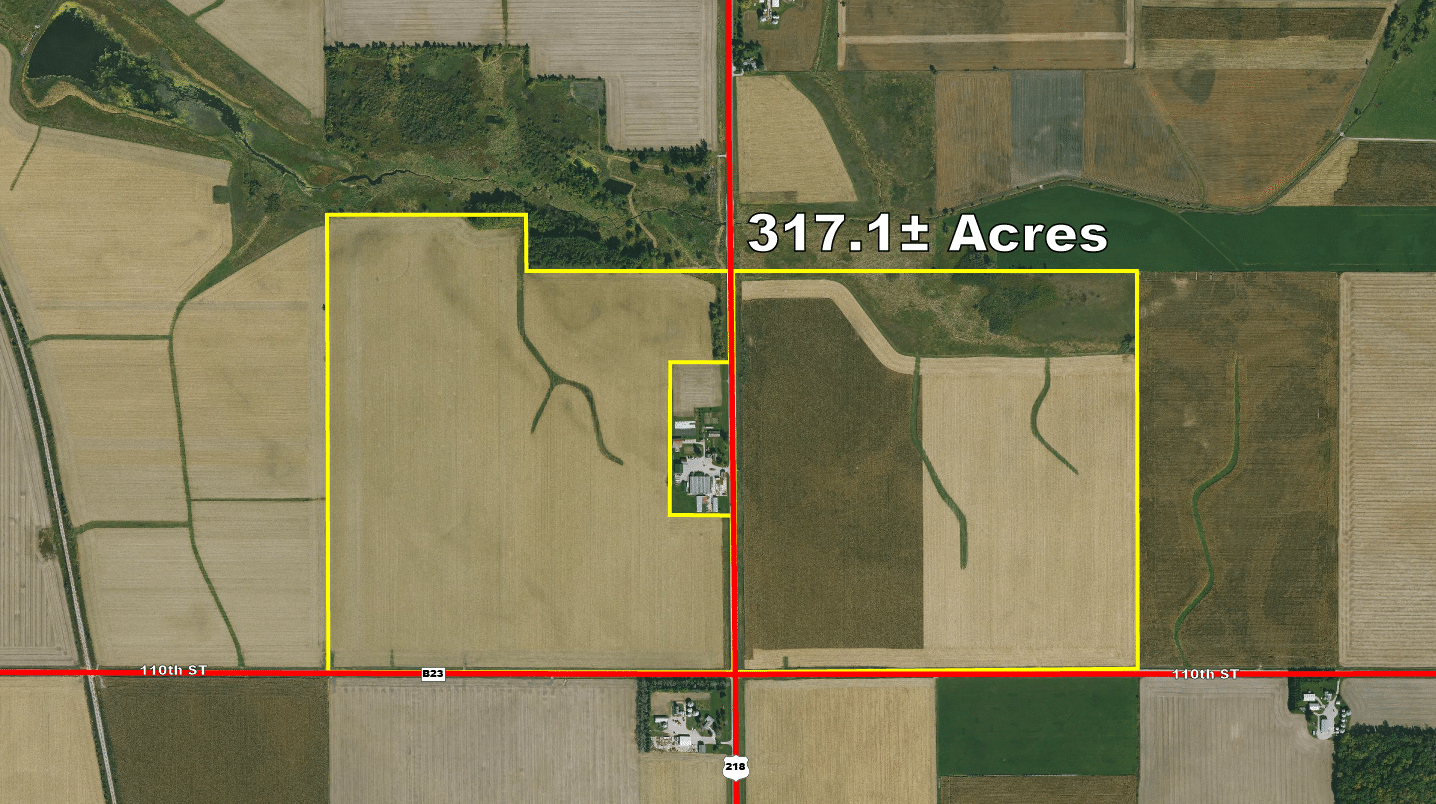

Floyd County, Iowa – 317.1± AcresCall for Price: 515-532-2878 Sign Up for Email AlertsDownload BrochureDownload Soil Map Property Highlights 84.9 CSR2 Productive Floyd Co. Farm Total Acres: 317.1. Tillable Acres:… Learn more317.1± Acres

Floyd County, Iowa – 317.1± AcresCall for Price: 515-532-2878 Sign Up for Email AlertsDownload BrochureDownload Soil Map Property Highlights 84.9 CSR2 Productive Floyd Co. Farm Total Acres: 317.1. Tillable Acres:… Learn more317.1± Acres -

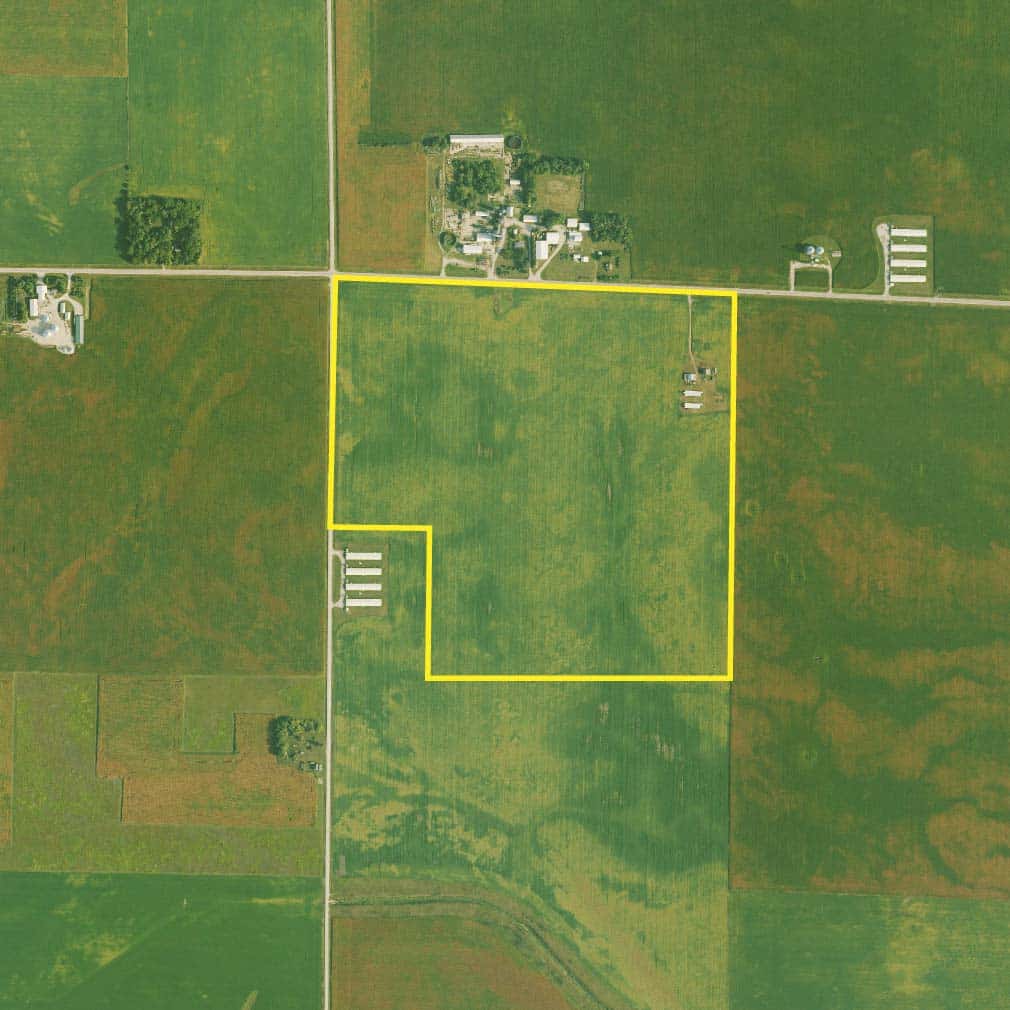

Humboldt County, Iowa – 147.68± AcresA productive Humboldt Co. farm that is nearly all tillable with a CSR2 of 84.6.147.68± Acres

Humboldt County, Iowa – 147.68± AcresA productive Humboldt Co. farm that is nearly all tillable with a CSR2 of 84.6.147.68± Acres -

The farm consists of 36 total acres including approximately 33 organicly certified tillable acres. The farm has historically grown tomatoes in high tunnels.

The property is unpreserved.

There are an additional 129 tillable acres available that are are adjacent to this farm.

The farm consists of 36 total acres including approximately 33 organicly certified tillable acres. The farm has historically grown tomatoes in high tunnels.

The property is unpreserved.

There are an additional 129 tillable acres available that are are adjacent to this farm.