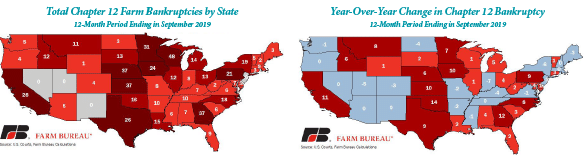

The American Farm Bureau Federation reported in October that farm bankruptcies (Chapter 12) were up 24 percent in the 12-month period ending September 2019 from the previous period. This statistic made a number of headlines, usually in tandem with a mention of the trade war and tariffs on grains. This may have made many readers think that Midwest corn and soybean farmers were filing at record rates when this was not the case.

Farm bankruptcies in the “I” states of Illinois, Indiana and Iowa are up, but there were only four more bankruptcies in this 12-month period than in the previous period. The bankruptcies in the U.S. mostly occurred in specific areas, such as the Plains (Kansas, Nebraska, Oklahoma), and with specific types of farms such as dairies that have endured prolonged periods of low milk prices. (Wisconsin had the most Chapter 12 bankruptcies during this period.)

Also, don’t be surprised to see Chapter 12 bankruptcies climb again next year as the Family Farmer Relief Act was signed into law in August, raising the debt cap for Chapter 12 bankruptcy relief to $10 million from $4.1 million. This will undoubtedly lead to farmers that would have had to file under Chapter 11 previously to now file under Chapter 12, distorting the numbers for the immediate future.