By Murray Wise

My career in selling, managing, and investing in farmland has now spanned into four decades. Some days I feel like I’ve seen it all. Others, I can be completely shocked by something I’ve never seen before. This is part of the beauty in working in agriculture and with some of the best people in the industry. When I think about where the farmland market currently is, I can’t help but be reminded of different times throughout my career and similarities we currently share with those times. That being said, when I think about the farmland market as a whole right now, it feels more like one of those days where I’m seeing something completely new.

In the investment community, farmland is known as an inflationary hedge. Many high net-worth landowners, as well as institutional investors such as pension funds, own significant portfolios for just that purpose. However, they aren’t the only ones that have benefited from this aspect of farmland. I know many farmers with long-held farmland which could be rented today for what they bought it for! Farmers are historically the biggest beneficiary of the returns of farmland as an asset class. Investors have arrived late, comparatively.

Farmers and investors alike will benefit from farmland ownership in our current situation as well. It seems almost every morning I turn on a business news channel and see a panel discussing the prospect of looming inflation. This isn’t without good reason either. With trillions in stimulus coming down the pipeline I have my own concerns of inflation. That being said, I will leave it to the morning show panelists to discuss just how much inflation we will see and instead focus more on what happens should we see inflation go to modestly high levels.

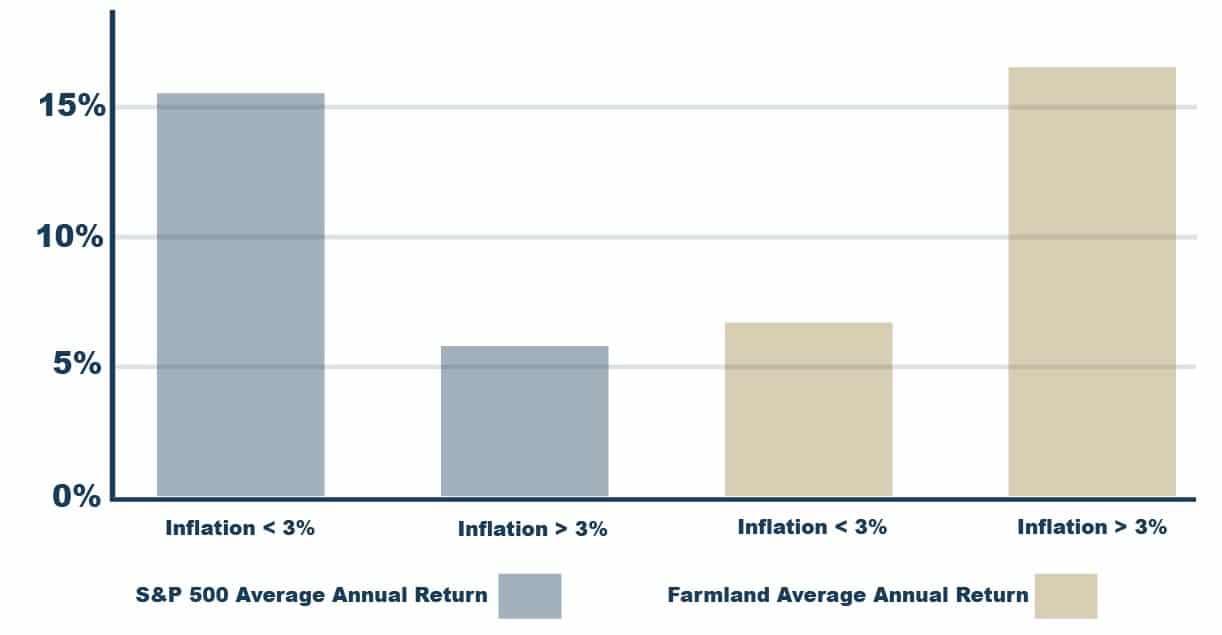

Since 1928, per NYU, inflation in the U.S. has averaged about 3.1%. Using 1928 as a starting point and the data provided by NYU, the stock market has had an average return of 6.3% annually when inflation is greater than 3% and an average return of 15.7% annually when inflation is less than 3%. From a historical perspective, periods of moderately high inflation have not been good periods for equities.

Comparatively, using data from, Purdue University, Iowa State University, and the USDA in years in which all provide data on farmland appreciation and returns, since 1968 farmland has returned 16.2% annually in years when inflation has been greater than 3% and has returned 7.8% annually in years when inflation has been less than 3%. In fact, historically, farmland has shared a greater correlation to inflation than to the global stock market, S&P 500, bonds, commodities, and REITs.

Today, inflation is still quite low by historical standards and is not currently above the 93-year historical average 3% mark. However, the evidence is clear, there doesn’t need to be hyperinflation for farmland to outperform and for equities to underperform relatively. Should we see even 4% inflation, farmland will likely be one of your top performing assets. I’ll leave it to you to watch the morning shows and listen to your podcasts to make your own inflation predictions, but 4% doesn’t seem too unreasonable to me with the amount of fiscal stimulus and the current monetary policy.

Another factor farmers and investors both consider is return. Whenever making an investment there is always an opportunity cost. Where else can you put your money? Interest rates have started to creep up recently, although in real terms, not noticeably unless a few basis points alters your investment outlook. My bank locally is offering CDs at .0.25% APY with $50,000 minimum deposit to open. Carnival Cruise earlier this quarter issued billions in unsecured debt at only 5.75%. My wife and I love going on cruises and can’t wait to get back to doing so. That being said, a 5.75% return on unsecured debt for a company that is barely operating shows just how difficult it is to find returns in fixed income. Those targeting annual cash returns on an asset that is likely to appreciate should look to safe investments in farmland. The highest quality farms in Illinois, Indiana, and Iowa return 2-3% annually, while not only providing more safety than a similar returning fixed income product, but also appreciating in value in times of high inflation. I can’t remember a time in my nearly 50-year career when I felt as good about owning land as I do right now. If you don’t own any yourself, it may be time to consider doing so.