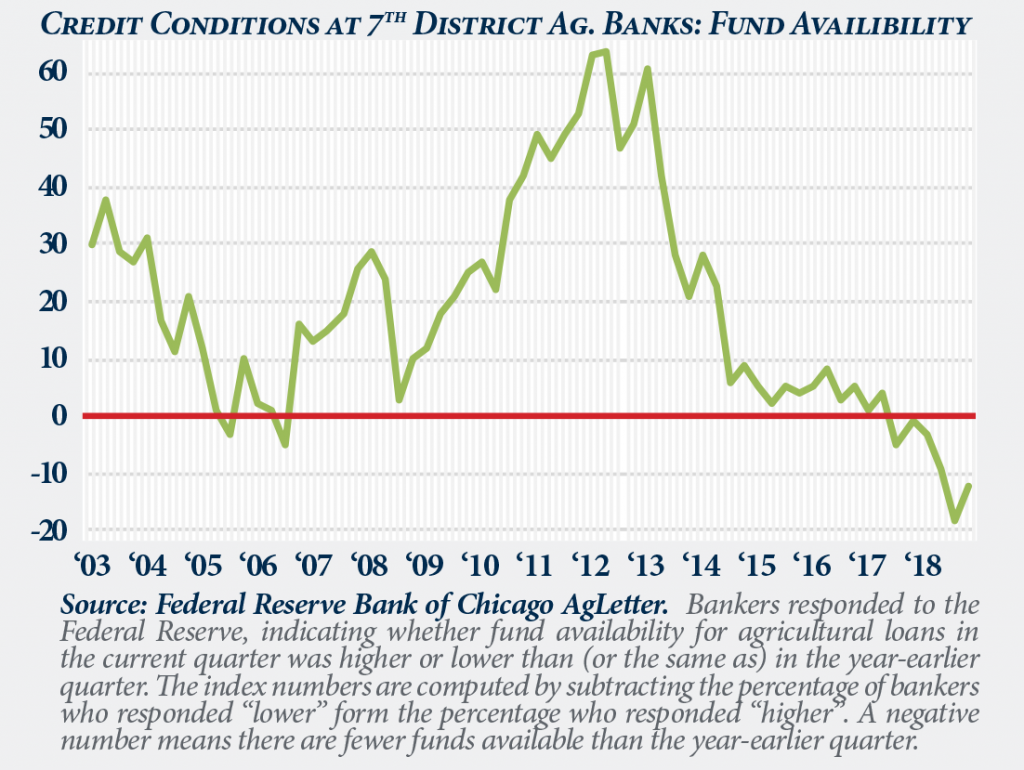

Farming operations are finding it more difficult to deal with current operating debt and to get approved for financing. This is demonstrated by the Chicago Fed AgLetter’s loan demand and funds availability indexes.

To determine these indexes, ag bankers are asked whether conditions in the current quarter are better or worse than those of the same quarter the previous year. In the fourth quarter of 2018, respondents reported fewer funds available for the sixth straight quarter and increased loan demand for the 21st consecutive quarter.

In addition to the tightening credit market, debt has become more expensive as interest rates rise. In 2019, debt will necessitate a greater amount of collateral than it did in 2018, according to the surveyed bankers.

In addition to the tightening credit market, debt has become more expensive as interest rates rise. In 2019, debt will necessitate a greater amount of collateral than it did in 2018, according to the surveyed bankers.

With traditional sources of debt becoming less available for operations, an opportunity has arisen for alternatives in agricultural financing.

Institutional capital has been in no short supply in the agricultural industry in recent decades. In the past few months alone, the states of Rhode Island, Louisiana and New Jersey have announced commitments to agricultural funds. These funds have focused primarily on the acquisition of agricultural land assets.

Meanwhile, a number of private investors and funds have been looking at the credit market as an area of opportunity. Principally, they have offered lending alternatives to agricultural land owners and operators who may be at risk in the current ag economy and who may find it more difficult to get loans from traditional lenders.

Essentially, these nontraditional or so-called “alternative” lenders are filling the gaps between what’s needed and what traditional lenders are willing to finance in this tightening credit market. In doing so, the alternative lenders are creating a market for investors looking to gain exposure to the agricultural sector.

Alternative lenders, while being higher-risk, provide many benefits for investors over a land-owning investment fund. These benefits include having a higher yield, higher liquidity and fewer regulatory burdens.

Alternative funds have not just created opportunities for investors, but for many borrowers, they have offered a lifeline. For those with no other financing options, the funds at least provide an option to stay in the game. However, in the long term, alternative loans don’t constitute a winning strategy.

While traditional financing may be more difficult to acquire in the current market, it should still be viewed as the long-term solution for operators and landowners alike. It is cheaper and offers longer terms than alternative financing does.

What alternative financing does offer is a path apart from traditional financing, and in most cases that means another year of farming.

I try to keep my commentary relevant to my work. By doing so, I can address current conditions in the ag industry. Last year I wrote about ag bankruptcies as I had been working on Eclipse Berry Farms and Las Uvas Valley Dairies bankruptcy cases. I mention this because, while anecdotal evidence isn’t the most precise, my involvement in those bankruptcies and other distressed cases led me to notice the increased presence of alternative lending funds in agriculture.

Earlier this year, MWA Capital Advisors closed on a deal to secure financing from an alternative lender when the operator’s traditional lender was unwilling to continue. This large California agricultural operation created a great opportunity for a fund that values LTV (Loan to Value) lending, and the fund was able to keep the operation going. Situations like this are truly a “win-win.”

While there are pros and cons to alternative lending, the biggest pro is that in most cases the borrower can avoid bankruptcy and eventually return to traditional lending. As these benefits are seen not only by the operators, but also by the lenders, I expect to see this industry continue to grow in coming years.

Institutional capital will continue to try to find its way into agriculture, and alternative lending may be one of the most inviting avenues to do so. Most institutions are no stranger to investing in a sector through debt.

With a growing population and an appetite not just for food but for the land that grows it as an investment, look for alternative debt funds to be an industry that will grow and become a destination for capital.

By Ken Nofziger. Ken Nofziger is president of MWA Capital Advisors. For information on agribusiness advisory,

please call (217) 398-6400