Last year when writing my commentary for this newsletter, it was hard to draw conclusions on the Midwestern agricultural land market due to the relatively small volume of transactions. While land prices generally declined, I noted that in the transactions that had occurred, high-quality land was maintaining its value better than lesser-quality land.

That has continued to be the case this year with much greater transactional volume — but at the same time, markets are more neighborhood-specific than ever. This year I have seen extremely high-quality farmland sell for more than $13,000 per acre and similar farmland less than 15 miles away sell for $9,000 per acre. The difference between these farms was not their potential yield or the cost of operating, but the local farmers and the investors in the area.

The biggest difference I have seen from 2017 to 2018 in terms of the farmland market is not in the result of the sales, but in the number of sales.

I have seen estate situations and distressed cases continue to be major reasons for transactions this year in addition to a number of other reasons for selling farmland.

Also, a trend that has been gaining momentum in the past few years and was especially true this

Also, a trend that has been gaining momentum in the past few years and was especially true this

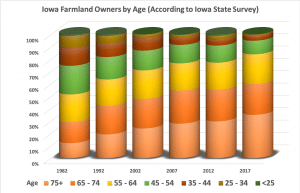

year is retiring farmers as sellers and/or landlords. This trend will likely continue to broaden, with farm incomes down again in 2018, and 60 percent of Iowa farmland being owned by people 65 years old or older (a third owned by people older than 75!), the idea of either cash-renting or selling land is starting to become more popular for aging farmers.

Historically the succession plan for many family farms has been to pass the farm to the children for them to farm. However, for families in which their children have moved away from the farm, we have seen renting or selling become the “go-to” options. As an example we recently completed a series of sales in Ohio with our long-term partner, The Wendt Group in which a prominent farm family sold its operation to retire successfully.

In summary, I see the farmland market as very similar to this time last year, with slightly higher transactional volume. Prices of high quality land have and will continue to hold their value better than low quality land, and rents will likely be down slightly in 2019 again as they were in 2018.

The 2018 farmland market has been easier to make sense of due to the quantity of sales and I expect 2019 to be that way as well, which is good news for our readers looking for more acres.