Historically we have devoted a portion of the fourth quarter Wise Ag Update to take a look back at the year that was, however, to do 2020 justice I would need much more than the space allotted here. To say this year has been unique would be a colossal understatement. As with virtually every other industry, COVID-19 significantly impacted agriculture. Early on during the pandemic, society hit the panic button with our food supply. A wave of infections crippled meat processing facilities and limited the availability of meat in grocery stores, creating a logjam in the supply chain and causing retailers to limit individual purchases on meat.

The farm real estate sector has not been immune to the effects of COVID-19. Selling farmland at public auction is one of the most popular ways to market a property, historically getting a room full of interested bidders and then letting those buyers bid their best price. However, it’s nearly impossible to hold a “normal” farm auction in our current environment with restrictions on crowd size and other social distancing mandates. What these roadblocks have done is caused us to be creative in the way we, and brokers/auctioneers in general, have marketed farmland in 2020. For example:

Sealed Bid Method: MWA held a sealed bid sale early on during the COVID-19 wave and it was very successful. We marketed a 208-acre farm in Champaign County, IL using the sealed bid process and offered the farm in three tracts. Bidders were able to submit their bids by mail on both individual tracts and combinations to our office by a set deadline. Once all bids were received, we analyzed the offers and the seller chose the combination of bids that netted the highest purchase price. Ultimately the farm sold to two buyers, both local farmers.

Online Auctions: MWA has offered online streaming of our auctions for many years, and we have sold multiple farms to bidders who were bidding over the phone while watching a live stream of the auction. However, 2020 was the first time we offered 100-percent online bidding with no physical, in-person auction. We offered multiple properties for sale in this manner and sales results were quite strong on all of them. The high-water mark was a 71-acre farm in Champaign County, IL that sold for $13,711 per acre to a local investor.

Live Auctions. If you would have told me in January that we would only conduct two live in-person auctions in 2020 I would not have believed you. We held one live auction very early in the year before the pandemic became widespread. We held a second one later in the year where we were forced to limit crowd size; we kept everyone that did attend at least six feet apart, and we had plentiful amounts of face masks and hand sanitizer.

Private Treaty Sales: These types of transactions are definitely not a new sales method, but historically have not been as favored as auctions. In 2020, though, we sold more properties using this method than any other. It will be interesting to see how many sales trend back towards auctions in 2021.

Additional Methods: There has been a variety of other methods that I have either seen or heard about. Some firms are combining some of the above methods, where bidders submit sealed bids to distill the number of buyers down to a reasonable amount of bidders, and then that select group is invited for a private in-person auction. In North-Central Iowa earlier in the summer, an auctioneer held a sale where bidders stayed in their vehicles and everyone tuned to a specific radio station where the auctioneer called the sale. Bidders flashed their headlights if they wanted to bid.

Regardless of the sales method, one thing has been consistent – the demand for farmland during 2020 has steadily grown. This increased demand, coupled with a low inventory of farms, has caused a steep uptick in prices this fall/winter. There are multiple reasons for strong demand.

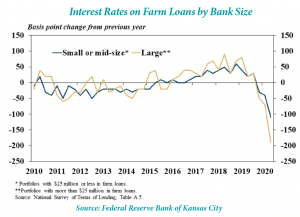

One of the primary drivers has been low interest rates. Farm buyers are seeing rates that are at or near historic lows. These low rates are a benefit to all buying groups, from farmers to individual investors to large funds. The lower the debt service cost, the more dollars per acre buyers can afford to pay for the farm.

A second reason for increased demand is that many believe we will see increased inflation in the coming years as a result of federal money being injected into the economy through multiple stimulus packages. Farmland has historically been a favored inflation hedge with investors with its ability to show long-term appreciation and a reliable annual income stream. We’ve spoken with numerous investors seeking to add to their land holdings and almost every one mentioned impending inflation as a main factor in their decision.

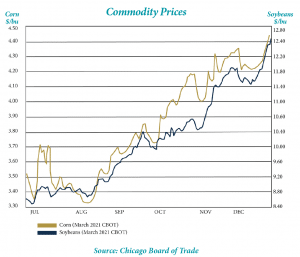

A third factor fueling the demand side of the equation has been the steady recovery of corn and soybean prices. This is allowing producers to see more profit, which allows them to be more active bidders for farmland, as well as pay higher rents to investor landlords who in turn can be more aggressive on their land acquisitions. Many analysts are predicting corn and soybean prices to remain at or near current levels in 2021, which would help keep farmland demand at its current levels.

As I mentioned earlier, while demand is very strong the supply side is very thin. I have been in this business for nearly 20 years and I can’t remember the last time there were this few farms on the market. We have a number of clients who were considering selling their land, but many are holding off at the moment. All of them have told us variations of the same reason – “If I sell, I don’t know what I will do with the cash.” In my opinion that is one of the main factors driving the low supply. For older landowners who don’t need the cash, farmland is a safe and steady investment. When you look at some low-risk alternatives such as CDs, Treasury bills, and bonds, farmland will likely yield a higher return. The stock market offers the chance to beat farmland returns but offers much higher risk. Commercial real estate may be looking at some choppy waters ahead with more and more companies realizing employees can work from home and maintain productivity.

While farmland returns are not headline-grabbing, the ability to own a hard asset with zero vacancy that generates a steady return and historically has shown long-term appreciation is a very attractive investment in today’s world. It’s always hard to predict where farmland values will go in the future, but I don’t see any of the variables on either the supply side or demand side changing much in 2021. I think we will continue to see strong demand for farmland from all types of buyer groups. That demand, coupled with a continued low supply, will likely continue to keep prices very strong.

By Eric Sarff

President, Murray Wise Assoicates